As gold hits a 5 month high (at time of writing) Investment commentators worldwide are all agreeing on one thing: it appears that the ‘perfect storm’ is on the horizon for this safe-haven asset.

Most investors will know, historically the price of gold rises in times of Political and Economic unease. With Geo-political tensions currently rising throughout the world due to tensions between the U.S., North Korea, and Russia, investors seem to be running to the safe-haven asset of gold.

Let’s not forget the element of Brexit, also in-motion but with no clear roadmap as to how that will pan out yet. In France, Le Pen and the upcoming elections there, will further shake up the economic landscape depending on that outcome.

This uncertainty is supporting physical demand for gold, with holdings in SPDR Gold Shares, the largest exchange-traded fund backed by gold, rising 4.2 metric tons to 842.4 tons as of Tuesday. That’s the highest in more than a month.

The simple fact is in times of turmoil gold tends to go upwards in price. The past has shown that gold is a great hedge, when stocks & shares markets are falling your gold should then be performing well…this is the very essence of a good financial hedge.

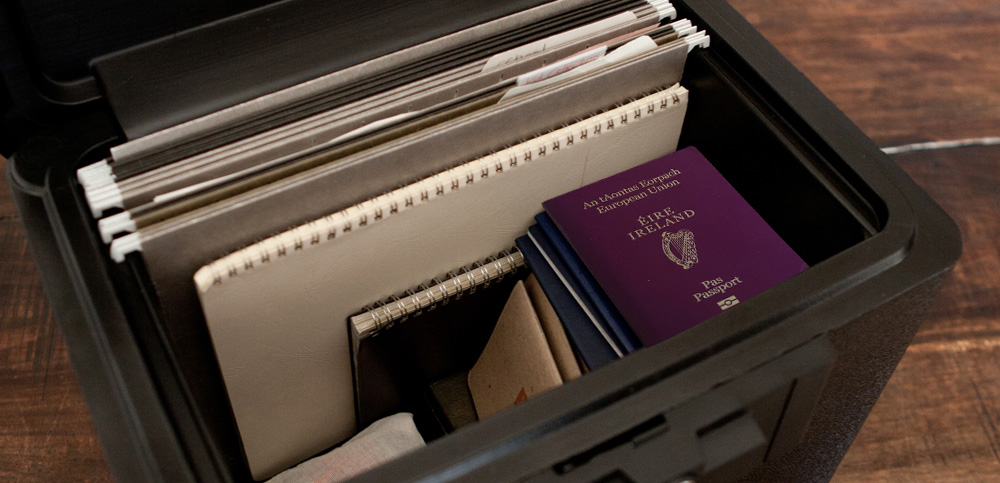

When it comes to precious metals though, the most regular advice is to buy and own PHYSICAL metals. With what appears to be ‘the perfect storm’ forming for the price of gold to increase, the Bulls are on the prowl and smart investors are following suit putting their money on gold.

As J.P. Morgan once said – “Money is gold, and nothing else.”

For further information on Merrion Gold call: +353 (0)1 254 7900 or go to: www.MerrionGold.ie